Do you require a financial advisor for your financial management? If you’re like many Americans, you may require assistance. According to the National Financial Education Council, the average American loses $1,200 per year due to a lack of personal finance knowledge. Finding a good financial advisor can assist you in avoiding these costs and focusing on your goals. Financial advisors aren’t just for the wealthy; working with one is a good option for anyone who wants to get their personal finances in order and set long-term goals. Follow these steps to find the best financial advisor for your needs.

1. Determine Which Aspect Of Your Financial Life Needs help

Decide which aspects of your financial life require assistance before speaking with a financial advisor. When you first meet with an advisor, you should be prepared to explain your specific money management requirements.

Remember that financial advisors offer more than just investment advice. The greatest financial planner will be able to assist you in charting a route for all of your financial needs. This might include retirement investment advice, debt payback, insurance product recommendations to protect yourself and your family, and estate preparation.

Depending on your stage of life, you may not require extensive financial preparation. Adults with simple financial lifestyles, such as young people without children or major debt, may just require assistance with retirement planning.

People with complicated financial demands, on the other hand, may require further support. They may want to set up college accounts or trusts for their children, manage difficult debt payment scenarios, or address challenging tax concerns. Because not all sorts of financial advisers provide the same set of services, select which ones you require and let that drive your search.

2. Learn About The Different Types Of Financial Advisors

There is no federal legislation that governs who may call themselves a financial counsellor or give financial advice. While many people call themselves financial consultants, not all are looking out for your best interests. That’s why you should carefully vet potential financial advisors to ensure they’re a suitable fit for you and your money.

The understanding fiduciary obligation is an important part of knowing about the many sorts of advisers. Some, but not all, financial advisors are bound by fiduciary responsibility, which means they are legally obligated to act in your best financial interests. Other people who call themselves advisers are merely held to a suitability requirement, which means they may only recommend goods that are appropriate for you—even if they are more expensive and you pay a greater fee. (However, the SEC is attempting to control this by restricting the use of the term “advisor” to those who adhere to a fiduciary standard.)

Whatever type of advisor you pick, be sure you understand how they generate money. This allows you to decide if their advice is best for you—or for their pockets.

Here’s how to consider the many sorts of financial advisors:

Fee-Only Financial Consultants

Charge-only financial advisers make money by charging you a fee for their services. These costs may be charged as a percentage of the assets managed on your behalf, as an hourly rate, or as a flat amount.

Fiduciaries are almost always fee-only advisors. In general, they have decided to work on a fee-only basis in order to avoid any potential conflicts of interest. Because their income is derived from customers, it is in their best interest to ensure that you end up with the greatest financial plans and financial goods for you.

Commission-Paying Financial Advisors

Some financial advisors receive money from third-party sales commissions. Some financial advisers who earn sales commissions may advertise as “free” financial advisors who do not charge you anything for advice. Others may impose fees, implying that third-party commissions are merely a portion of their revenue.

Financial advisers that earn third-party sales commissions make some or all of their money by selling you financial products. If you want to deal with a financial advisor that receives sales commissions, you must exercise extreme caution.

Fiduciaries are not commission-only advisors. They work as investment and insurance brokerage salesmen and are merely held to appropriateness rules. Some fee-based financial advisors, on the other hand, are fiduciaries. However, it’s vital to identify whether they always behave as fiduciaries or if they “pause” fiduciary obligations while discussing particular types of goods, such as insurance.

Keep in mind that commissions aren’t inherently negative. They aren’t even always red flags.

Some financial products are primarily marketed on a commission basis. Consider life insurance: When advising on other financial products, a fee-based planner who receives income for assisting you in purchasing a life insurance policy may still have your best interests at heart.

“To be clear, paying the commission for life insurance is not wrong,” says Karen Van Voorhis, a fee-based certified financial planner (CFP) and Director of Financial Planning at Daniel J. Galli & Associates in Norwell, Mass. “That’s how the industry’s structure works.”

Buying financial goods through commission-based financial advisers may be a question of convenience, especially if someone will receive a fee regardless of where you buy the product. What matters is that you comprehend the distinction. And, if you deal with a fee-based financial advisor, be aware of when they are operating as a fiduciary, particularly when assisting you in the purchase of financial goods.

Registered Investment Advisers (RIAs)

Companies that provide fiduciary financial advice are known as Registered Investment Advisors (RIAs). Investment Advisor Representatives (IARs) work for RIAs and are held to a fiduciary standard. An RIA may use a single IAR or hundreds of them.

IARs may refer to themselves as financial advisers and may work on a fee-only or fee-based basis. Some may have additional certifications, such as the CFP designation (certified financial planner).

“The CFP accreditation is truly the gold standard in the financial planning field,” adds Van Voorhis. A CFP credential signifies that a financial planner has completed difficult professional tests in real estate, investment, and insurance planning, as well as years of expertise in their respective professions.

CFPs are uniquely qualified to help you plan for every aspect of your financial life due to their extensive knowledge.They may be especially beneficial for people who have complicated financial problems, such as handling huge outstanding debts and preparing wills, trusts, and estates.

Robo-Advisors

Robo-advisors provide automated, low-cost investing advice. Most specialise in assisting clients in investing for mid- and long-term goals such as retirement by building diversified portfolios of exchange traded funds (ETFs).

“A robo-advisor only to manage retirement savings may be a fantastic option for younger folks who are highly tech-savvy,” says Brian Behl, a CFP at Behl Wealth Management in Waukesha, Wisconsin. “I don’t think they’ll get as much in-depth guidance on insurance, retirement, and taxes.”

People with sophisticated financial requirements should definitely seek the advice of a traditional financial adviser, but several robo-advisors provide financial planning services a la carte or to higher-net-worth clients.

While robos have indeed altered the sector,

“I believe there is still a need for human advisers right now,” says Corbin Blackwell, a CFP with robo-adviser Betterment.

Personal Capital, Wealthsimple, and Betterment, for example, allow clients to purchase individual financial advisory sessions, and Personal Capital, Wealthsimple, and Betterment provide regular financial planning for clients with bigger account balances for a management charge.

3. Identify Which Financial Advisor Services You Require

Financial advisers’ services differ from one another, although they may provide any of the following:

- Investing advice Financial advisers do research on various investment possibilities and ensure that your investment portfolio remains within your intended level of risk.

- debt administration Financial counsellors will work with you to create a repayment plan if you have outstanding obligations such as credit card debt, school loans, vehicle loans, or mortgages.

- Budgeting assistance Financial counsellors specialise in determining where your money goes once it leaves your paycheck. Advisors can assist you in developing budgets that will enable you to meet your financial objectives.

- insurance protection. Depending on your financial condition, financial advisors may analyse your current policies to find any gaps in coverage or propose additional types of policies, such as disability insurance or long-term care coverage.

- Tax preparation Tax planning includes devising strategies to reduce the amount of taxes you may owe, such as large charitable contributions or tax-loss harvesting. Remember that not all financial planners are tax professionals, and that tax planning is not the same as tax preparation. To submit your taxes, you will almost certainly want the services of a CPA or tax software.

- Retirement preparation Financial advisers can assist you in saving for your ultimate long-term goal, retirement. Then, after you’re retired or nearing retirement, they may assist you in keeping your money safe.

- Planning your estate Financial advisers can assist you in transferring your money to the next generation, whether it’s family, friends, or charity causes if you want to leave a legacy.

- College preparation. If you want to pay for your loved ones’ higher education, financial experts can help you create a strategy to save for their education.

Financial advisers provide emotional support and perspective during unpredictable economic times, in addition to investment management and financial planning. For example, during the start of the coronavirus pandemic in March 2020, client demand for financial adviser contact jumped by about 50%.

“I believe that in these times, we may be a source of reason,” Blackwell adds. “We’ll make it through the storm.” “We created this portfolio for a reason.”

When selecting a financial adviser, ensure that they provide the services you require in both your financial and non-financial lives.

4. Establish the Maximum Amount You Can Pay Your Financial Advisor

Financial advisers used to charge a portion of the assets they handled on your behalf. Advisors now provide a wide range of fee arrangements, making their services more affordable to customers of various financial means.

Commission-only consultants may appear to be free on paper, but they may be paid a percentage of what you invest or buy. These “free” financial counsellors are usually found through investment or insurance brokerages. Remember that these advisers may only be held to appropriateness criteria, thus they may end up costing the same as or more than a similar financial product recommended by a fiduciary financial advisor.

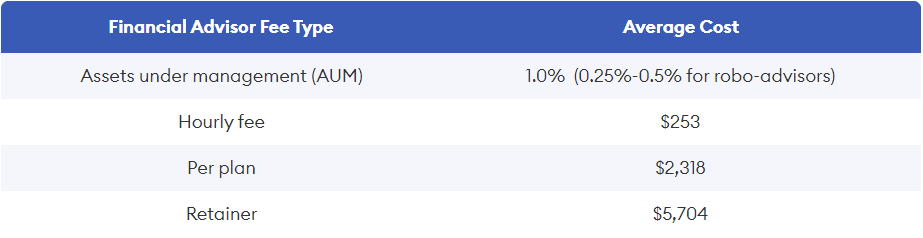

Fee-only and fee-based financial advisers may collect fees based on the overall amount of assets they manage for you (assets under management) or by the hour, plan, retainer agreement, or subscription model. The following table shows the average charge rates for financial advisors:

5. Investigate Financial Advisors

Because financial advisers come in a variety of shapes and sizes, with a wide range of specialities and offers, you must extensively study possible advisors. You want to ensure that the individual leading your financial decisions is reliable and skilled.

There are several ways to locate competent financial counsellors. Seek advice from friends, family, and peers. As an alternative, you can search for financial advisors online. Many reputable financial planning organisations offer free financial advisor databases.

- NAPFA (the National Association of Personal Financial Advisors)

- Garrett Strategic Planning Network.

- XY Preparation

- ACP (Alliance of Comprehensive Planners)

When considering advisers, keep their credentials in mind, as well as their backgrounds and pricing arrangements. FINRA’s BrokerCheck allows you to see disciplinary actions and complaints lodged against financial advisers. Also, just because someone belongs to a financial planning group does not indicate they are a fiduciary financial counsellor.

What to Ask a Financial Advisor

Make sure you learn the answers to these questions and are comfortable with their solutions at your first appointment with a financial counsellor.

- Do you act as a fiduciary?

- Are you constantly functioning in a fiduciary capacity? (When marketing commission-based products, certain fee-based advisers may not always serve as fiduciaries.)

- How do you make a living?

- How do you approach financial planning?

- What kind of financial planning services do you provide?

- What types of clients do you often work with?

- Are there any account minimums?

- Do you have any conflicts of interest when it comes to managing my money?

- What information do I need to bring with me for you to consider while creating my financial plan?

- How frequently and how many times will we meet?

- Will you work with my other consultants, such as CPAs or attorneys?