Loans for small businesses can benefit from a quick infusion of capital for both new and existing businesses. We can help you get the business financing you need, whether you want to expand your business, renovate your facilities, or buy more inventory. Although there are many different kinds of business loans on the market, Capalona can assist you in choosing the one that is best for your circumstances and growth goals.

What is a small company loan

Loans for small businesses or Small company loans are a sort of commercial financing that aids in ensuring that businesses have adequate capital to pay for ongoing operational expenses. You may be able to easily and affordably finance your business operations with a small business loan. This kind of loan may be applied for practically any company need, including increasing cash flow, buying equipment, hiring personnel, or paying unforeseen expenses. You may customise a small company loan from one of our alternative lenders or a government-backed programme to meet your unique needs.

Are unsecured or secured small company loans available

Loans for small businesses or business owners in the UK have access to both secured and unsecured small business loans. Unsecured loans sometimes include lower sums, greater costs, and shorter timeframes of payback. However, if you need a bigger loan, you might be able to get more money at a better rate by using an asset as collateral. See our comparison guide and infographic for more information on the main differences between secured and unsecured business loans.

What kinds of loans are available for businesses

Loans for small businesses or Small company loans come in two basic varieties: secured and unsecured, as was already discussed. For UK SMEs, there are several different kinds of loans and funding solutions available within three major categories:

- Cash loans

- advance on merchant credit.

- Bill financing

- Loans for working capital

- Asset refinancing and financing

- Peer-to-peer loans

- Facilities for revolving credit

With an unsecured business loan, you may take out a loan without having to pledge any of your company’s assets as collateral. Loans for small businesses who don’t have a lot of readily available collateral to use as security frequently use this. In contrast, businesses that take out secured business loans do so with the understanding that if they fail to make their loan payments, the lender will have the right to seize the agreed-upon asset and hold it in reserve until the debt is repaid in full.

Which small company loans are the best

There are several things to take into account while looking for the best small business loan for your company. There is no one way to get the money that can be called “the best,” no matter how much you need it or how easily you can pay it back. However, you must ensure that the small business loan you select will provide you with the precise amount of funding you require, competitive interest rates, and convenient repayment terms. At Capalona, we are dedicated to assisting businesses just like yours in locating the best loans for small businesses for their operations.

What distinguishes a personal loan from a company loan

Business loans are only permitted for operations and corporate purchases. Some examples of this include using your loan to finance company growth or to purchase new inventory and equipment. A personal loan is different from this because it is meant for personal use. Lenders usually put restrictions on personal loans that say they can’t be used for business, and the same goes for business.

What are the terms of a small company loan

Loans for small businesses or any other form of business financing are the same as a small business loan. The creditor provides you with money upfront, and you return it over the course of an agreed-upon period, together with any applicable interest and fees. Unsecured business loans, secured business loans, merchant cash advances, peer-to-peer business loans, and invoice finance are just a few of the many funding choices that fall under the umbrella phrase “small company loan.”

The structure and method of repayment for each form of loan might differ. Some, for instance, permit you to withdraw money as and when you require it. These are referred to as revolving credit facilities or lines of credit. They are far more adaptable and function much like a credit card, with interest-only being charged when you actually use it.

Loans for small businesses or Depending on the loan you select, you might have to provide a business or personal item as collateral. If you don’t follow your repayment agreement, the lender may seize your property. As a result, you should carefully analyse this choice.

How long is the term of a small company loan?

Depending on the precise SME funding solution you select for your company, the period of your small business loan will vary. Small company loans are often obtained for a shorter duration. But there are a lot of things that go into this, like:

- The loan amount you desire

- What kind of business financing do you need?

- Given the interest rate, how quickly can you make repayments?

- What are the interest rates and costs for small company loans?

Depending on the lender and the sort of funding package they offer, small business loan rates and fees will vary widely. Your company’s activities, including performance, industry sector, and credit history, might also have an impact on the rates. Even while interest rates are often constant, they are sometimes variable, which means they can change at any point throughout the loan’s tenure. For loans for small businesses, At the beginning of the loan, all fees, charges, and payback conditions will be explained and agreed upon so that you are aware of the whole cost.

Our selection of loans provides all company owners peace of mind with affordable interest rates and flexible payback schedules. Even businesses that have been operating for less than six months are eligible for these short-term business loans for small businesses.

Do I qualify for a small business loan

If you’ve only recently started a business or have a poor credit history, it may be difficult to obtain a business loan from a traditional high-street bank. It’s important to realise that banks aren’t your only choice if you’re having problems like these. Small and medium-sized business loans (SME loans) can be gotten from a number of non-bank lenders and alternative lenders. Loans for small businesses or If you’re dealing with an unforeseen circumstance or seasonal swings, a short-term business loan could provide you with some flexibility.

It might be difficult and time-consuming to try to get money from a high-street bank. A short-term small company loan might be approved with Capalona in just a few minutes, and the money could be deposited into your account a few hours afterwards.

I have horrible credit. Can I still receive a small business loan

If you have a poor credit history, a small business loan from one of our reputable alternative finance sources is a great choice.

To meet certain demands, several lenders have modified their products. Even though you will pay more in interest if you have a low credit score, you may minimise your expenses by repaying the loan quickly.

Are personal guarantees required for small company loans

You almost always need to be prepared to sign a personal guarantee when applying for a small company loan. This legally binding promise basically says that if your business can’t make payments, you, as the business owner or company director, will be responsible for doing so on your own. For loans for small businesses, When you are seeking an unsecured loan product or if you have terrible credit and the lender needs more assurance before agreeing to let you borrow, personal guarantees are often more prevalent.

What credit score is required for a small business loan

There is no one credit score that will ensure that a small business loan application is approved. Most of the time, a lender will look at more than just your business’s credit score when deciding whether or not to lend money. This is because each lender has different criteria. Loans for small businesses, As was already noted, small company loans are simpler to qualify for with bad credit. This is due to the lender’s lower risk of loss when funding smaller quantities. You should keep in mind, too, that loans with lower credit scores typically come with higher interest rates and demand that you provide a personal guarantee.

What if I’ve tried before and failed to get a company loan?

If you’ve previously had a business loan application denied, it’s crucial to evaluate your financial condition and make sure that funding is the best option for your company. For loans for small businesses, There are actions you may take after being refused to raise your credit score and guarantee that any outstanding bills are settled.

You should be in a better position to apply for a small business loan after the financials of your company are in better condition. If you have any questions concerning your company when applying for finance, please get in touch with our staff at Capalona

How may a small company loan be used

Almost every company’s need may be met with a small business loan. You might need more money to buy more inventory, fix up or expand your workspace, hire more people, or buy the latest technology. For loans for small businesses, They can also be used to cover unanticipated expenses such as unanticipated expenditures and seasonal fluctuations in the economy.

What benefits can small company loans offer

It’s important to think over every detail of the loan agreement before borrowing money. These general benefits of small company loans are listed below.

Accelerate your growth potential—Working money is needed to take your company to the next level, and a small, short-term business loan provides a quick and economical approach to achieve your objectives.

Asset security is not necessary because most loans are unsecured. Most lenders, though, could provide you with the freedom to use your company’s assets as collateral for the loan if you so want.

maintain a steady financial flow. Managing cash flow can be challenging. You might be able to get the breathing room you need with the help of a short-term business loan.

What drawbacks are there to small company loans

Here are some significant drawbacks to take into account when applying for a small company loan.

The cost of borrowing: Although small company loans have low interest rates, both the cost and the principal still need to be repaid. These expenses can be reduced by making an effort to keep the payback terms as brief as feasible.

The cost of borrowing will be higher if you have a poor credit score since you represent a bigger risk to the lender. Applying for a loan when you can afford to pay it back might be helpful since doing so could help you raise your credit score.

How much credit might I get

You could be eligible for a quick, short-term loan from one of our dependable direct lenders for as little as £1,000 or as much as £500,000 with a small business loan.

Depending on how much you need, a lender can ask you to put up assets as collateral. The typical repayment period for small company loans is between six months and three years.

Can I make early payments on my business loan?

The majority of the lenders we work with do not impose any additional fees for paying off your business loan early, despite the fact that some lenders opt to do so.

Can I obtain a small business loan for my newly launched company

With our business loans for startups, we can assist you whether you are just starting to plan your firm or are already a few months into operations. We are in the greatest position to provide a financial option to launch your company concept thanks to a UK government-backed startup loans relationship. Use our loans for small businesses calculator for new businesses.

Do women have access to certain small business loans

Women who need operating capital have access to a variety of small company loans thanks to the UK’s rapidly increasing number of female entrepreneurs. Whether a business is a start-up or an established small business, specific financing is available from alternative business funding firms and government-backed lenders to assist women in growing their operations.

Capalona has negotiated a variety of small business loans for women entrepreneurs across the UK. So please get in touch with us right away if you’re a female business owner in need of finance.

Is a small company loan available without security

You may obtain a small business loan without providing any security. These loans are unsecured, so your company is not required to put up assets as collateral. For additional details, go to our page on unsecured business loans.

Is my company eligible for a small business loan

You must be authorised to conduct business in the UK in order to be eligible for a small business loan. Limited firms and single proprietors who have been in business for more than two years are often financed by lenders. However, financing will also be considered for start-ups, Loans for small businesses, and those with bad credit.

- trading for at least three months

- Those registered in the UK are a limited company, a limited liability partnership (LLP), or solo proprietors.

- Utilizing our quick online application form, you may apply for a small business loan in 2 minutes. In just a few minutes, one of our reputable lenders could approve you. Within hours of approval, the money could be sent to your account.

- Use our dedicated small business loan calculator to get a basic sense of costs.

- We can provide an alternative funding solution to meet your needs if you are not eligible for a small business loan.

How can I apply for a business loan

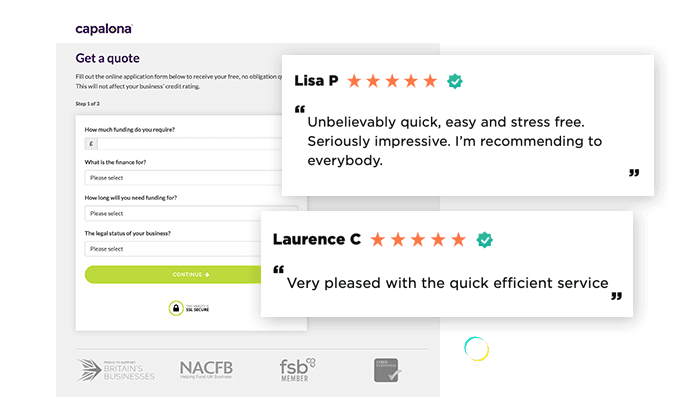

It is quick and simple to apply for a business loan with Capalona. It takes less than 5 minutes to complete our online application. In order to be able to provide you with the best solutions for your needs, we will ask you a few questions within the form. You will receive customised, no-obligation estimates from lenders on our panel after we have evaluated your company.

When you apply for a business loan, we will inquire about the following so that we can learn more about your company:

- The amount of money you’ll require

- What do you intend to do with the money?

- How long will you need it?

- The legal standing of your company

Why did I decide to arrange my business financing with Capalona

As a top business finance brokerage, Capalona specialises in setting up small business loans for UK-based businesses. Through our work with them, we have helped several startups and SMEs get the best small business loans at cheap rates. As was previously indicated, there are several options available for small company loans. Getting a second opinion might be helpful when making a financial choice since you don’t want to make a mistake.

To make sure that all businesses can access finance, we have established long-term connections with the lenders we deal with. This means that we will work to find you the best small business financing option even if your company has a history of bad credit. Working with and supporting small businesses is something we adore. When you apply for a business loan via Capalona, you can be confident you’re getting the best deal possible for the requirements of your business.