A well-designed stock trading apps to make money may make the process easier and more comfortable, whether you’re an aggressive trader aiming to achieve consistent profits on tactical short-or medium-term transactions or a passive investor trying to establish a solid long-term portfolio.

But how can you choose the best one when there are so many best free stock trading apps alternatives available, each providing a confusing variety of features and resources? In this quick introduction, we’ll talk about the benefits of stock trading apps to earn Money for your investing career, some of their unique features, and the types of investors who would benefit most from each trading app.

Few best free stock trading apps reddit can provide all the benefits of mobile investing in one package, but these cutting-edge solutions give investors of all experience levels access to a sophisticated mobile trading platform. Each has various characteristics that are distinctively geared to the kinds of investors that the developers had in mind when they created free stock trading apps to earn Money.

Best Stock Trading Apps For Beginners 2022

Here are some of our best free stock trading apps reddit, along with a brief explanation of what each one does and the kind of investments it’s best suited for. While these platforms are ranked according to their best qualities, you should also choose one that best suits your preferences, requirements, and objectives.

#1. Robin Hood

For equities, exchange-traded funds (ETFs), options, and some crypto app, Robinhood provides commission-free trading. You may purchase fractional shares, create personalised alerts, and receive frequent updates with the most recent investment-related news stories. This is a fantastic choice for novices because of how simple it is to get started trading and understand the basics of investing thanks to the user interface. Since its fractional shares make it simple to invest on any budget, it’s also a smart choice for individuals who wish to start investing with less money.

Robinhood doesn’t currently provide IRAs or other tax-deferred retirement accounts, so consumers who are saving for their retirement will lose out on tax protection. However, to understand how to maintain a portfolio, how trading works, and what to invest in, this is a straightforward process. Additionally, the abundance of news and data available will instil in new investors the practise of doing research on their assets, performing a technical or fundamental analysis, and deliberating carefully before making a purchase or sale. Additionally, the platform’s cost-effective setup makes it simple for novice investors to “value invest” and keep certain assets rather than sell them for quick cash.

#2. eToro

You may build a broad portfolio with eToro investing that is simple to maintain via the website or mobile app. You can view all of the information as soon as you open the app, making it powerful in terms of quantity. You may use the list of losers to decide whether to purchase at a discount, sell, or wait until the stock reaches its bottom. You may also use the list of movers to get a sense of where your best fresh prospects are. The vibrant and contemporary design is appealing, simple to use, and easy to follow as you develop your portfolio. Additionally, by using copy trading to match yourself with best practises, you may avoid daily informed guesses in favour of consistent outcomes.

#3. Webull

Another commission-free trading platform for stocks, ETFs, options, crypto, and more is Webull. Webull functions more like a sophisticated trading platform because of the breadth of analytical tools it provides, such as charts, graphs, and indicators, even though it was made into a user-friendly platform with investors who use mobile devices first in mind.

It’s an excellent choice for short- or medium-frequency trading because of its low-cost trading and abundance of free charting and technical analysis tools.Investors who know how to use charts and indicators will be able to start right away, but beginners can get by after playing around with the features for a while because there are enough learning tools and the design is simple enough.

#4. Cobra Trading

The Cobra Trading app is designed for day traders and scalpers, offering minimal commissions and DAS fee exemptions for high volume traders. The DAS (Direct Access Software) technology allows access to several exclusive data streams and provides speedier order execution. With Cobra Trading, you may experience simultaneous high-level analysis and lightning-fast trading by linking your brokerage account directly to your DAS platform.

Cobra Trading is unquestionably best suited to the high frequency, high volume trader, with an account minimum of $25,000 and cost exemptions only available for high volume trading.The DAS platform access, market data packages, and short-term location monitoring make this one of the most capable day trading or scalping apps available, albeit for high-frequency traders.

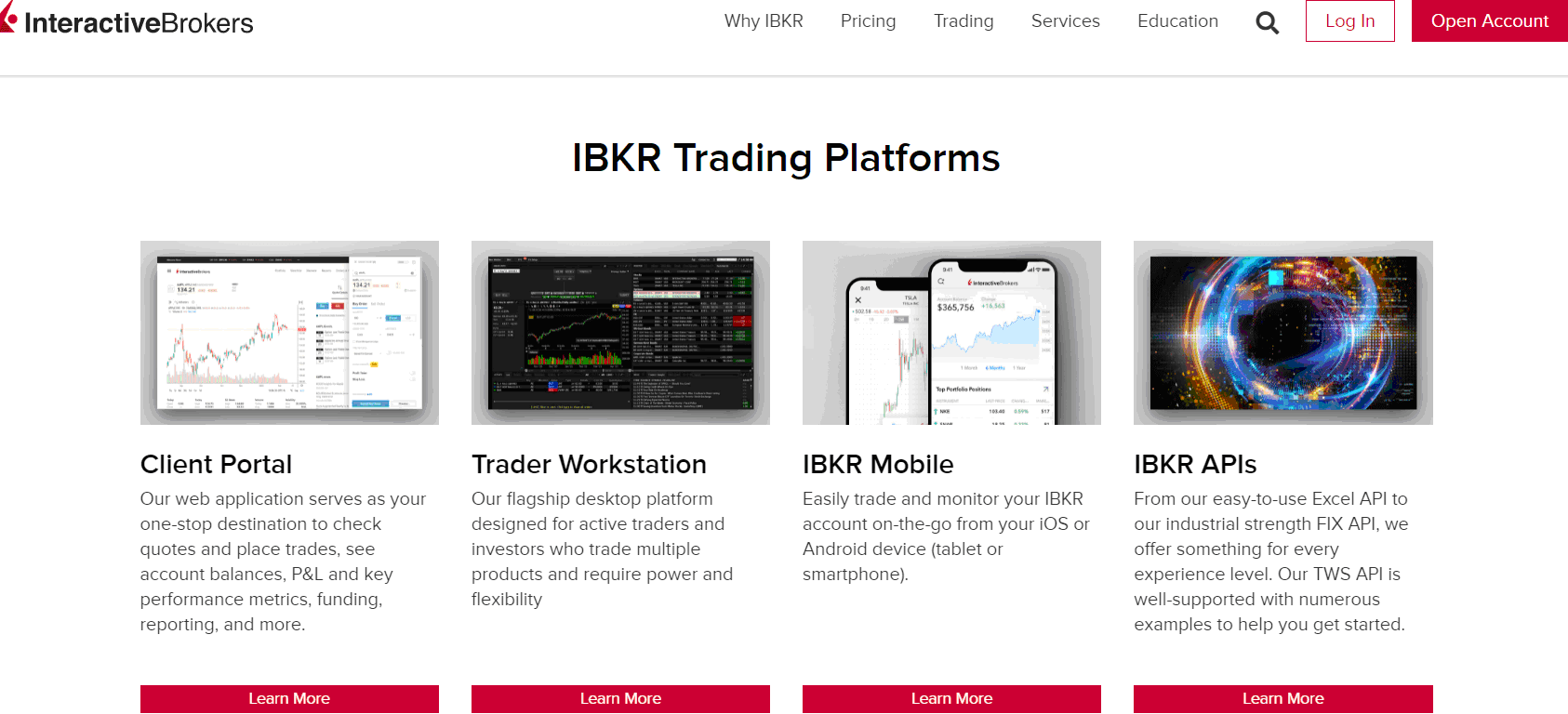

#5. Interactive Brokers

Investors who want access to a variety of tradeable assets may choose Interactive Brokers as one of their top alternatives. Stocks, options, futures, ETFs, mutual funds, currency, and even precious metals are available on the app. Users have access to international marketplaces as well. No matter what asset they like to trade, investors will have no problem assembling a balanced portfolio or taking advantage of a wide range of trading possibilities thanks to the abundance of accessible assets.

There are also several account kinds, such as IRAs and margin accounts, as well as light and pro plan types. A cost for inactivity is assessed under the pro plan if you don’t trade frequently enough despite having access to additional analytical tools necessary for high frequency trading. The light plan is great for passive investors or traders who don’t trade as often because it has less analytical tools but no fees for inactivity.

#6. SoFi Active Invest

Another excellent choice for passive investing that is suited to investors with less starting cash is SoFi Active Invest. Users may establish an account with no minimum requirement and purchase fractional shares while receiving free financial advice from the team of qualified financial advisers at Sofi Active Invest. Additionally, it provides some automation, such as recurrent investments, diversification, and regular portfolio rebalancing.

For those looking for a more hands-off approach to investing that doesn’t need in-depth study or strategy optimization, this is a fantastic resource. Make sure it provides the securities you’re interested in before opening an account, as it is lacking in mutual funds, options, and other assets that some investors might prefer.

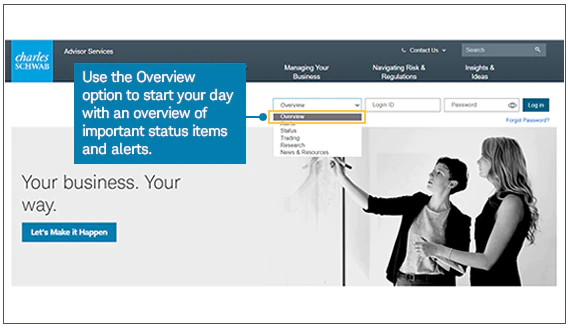

#7. Charles Schwab

Charles Schwab is a great app for a variety of investors and is another stock trading app backed by a big bank. Numerous account kinds, extensive fundamental and technical research tools, a wealth of instructional materials, as well as trading platforms with real-time quotes, screeners, technical indicators, pattern analysis, and more are all available. Not every tool or function is included in every platform, though.

If you want to experiment with other investment philosophies, you’ll have to switch between platforms. This won’t be a major problem for individuals who are dedicated to a certain investing approach. While aggressive day or swing traders will have access to the majority of the tools they want on StreetSmart Edge, more passive, buy-and-hold investors will find almost everything they need on TradeSource.

#8. Moomoo

With free access to Level 2 market data, Moomoo gives its users commission-free trading on more than 5,000 stocks and ETFs. For active or experienced traders searching for cheaper expenses and more sophisticated trading tools, this data is combined with over 50 technical indicators and other tools. For aggressive traders who must move quickly, submit orders as quickly as possible, and analyze the indicators that go with their methods, the app works effectively. This is very important because aggressive traders use numbers every day and stick to a plan.

How Do Stock Trading Apps Work?

Your portfolio is always close at hand thanks to stock trading apps. From your phone, you may check your assets and execute transactions. Even though many stock trading apps are made for a wide range of users, there are a few things that make investors decide to use a mobile stock trading app:

- News feeds with the most recent stories about your investments.

- Resources for education to sharpen the abilities of novice investors

- Charts, graphs, and indicators are analytical tools that can help you plan short- and medium-term trades.

- Automation features allow your phone to carry out your trading for you.

You can set up alerts to let you know when news, trends, and price changes occur so you can react to the market right away, even if you can’t keep an eye on the charts all day.

Use your preferred stock trading app to start investing:

The best stock trading app for you will ultimately be the one that provides the assets you wish to trade and was created with the type of investment you have in mind. Look for a tonne of analytical tools and perhaps some automation for shorter-term techniques like swing trading or day trading to make it simpler to stick to your plan.

Look for a stock trading app that provides in-depth research alternatives for delving into stock fundamentals, the types of shares you want to include in your portfolio, and maybe the chance to build a retirement account if you’re looking for longer-term strategies or retirement planning.

FAQ’s

Which stock trading app is best for beginners?

Apps that provide lots of instructional information while making it simple to place orders should be given top priority by novice investors (and understand the different kinds of orders you can place). Look for user-friendly interfaces, clear lessons or guidelines, and, most importantly, affordable prices so you aren’t paying more than necessary while you are still getting the hang of things.

Which stock trading app is the best?

There isn’t a single app that is the stock trading apps. Every platform has a unique mix of benefits and cons. The best app will be the one you feel most comfortable using and that has the features that work best with your trading strategy, whether that means more technical analysis, automation, fundamental research tools, or low-cost trading options like fee-free options trading or affordable fractional shares.

There is no perfect app. Therefore, the one that possesses the qualities that are most significant to you the stock trading apps.